tax benefit rule examples

How Does a Tax Benefit Work. That is they help determine what activities the government will undertake and who will pay for them.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

This represents the total amount of state income tax withheld from your wages in 2012 from your Form W-2.

. 9 The rule also applied when a tax-. Example of the Tax Benefit Rule Mr. For example if a taxpayer recovers an expense or loss that he previously wrote off against the prior years income then the recovered amount must be included in the current years gross income.

Plumb The Tax Benefit Rule Tomorrow 57 HARV. A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax burden. Tye The Tax Benefit Doctrine Reexamined 3.

On Schedule A they listed real estate taxes of 7000 and state income taxes of 7000. 115-97 TCJA Congress enacted new Internal Revenue Code Section 164 b 6 limiting individuals state and local tax SALT. 98369 amended section generally substituting provisions relating to recovery of tax benefit items for provisions relating to recovery of bad.

In 2019 A received a 1500 refund of state income taxes paid in 2018. Of the 1000 refund you receive from Iowa 400 of it will be taxable on your 2017 federal return. The most common example is a state income tax refund of tax deducted in the prior year.

8 For example the tax bene- fit rule applied when a seller reimbursed a buyer for interest that the buyer had prepaid and previously deducted. A couple paid 4000 in state taxes in the prior year and claimed itemized deductions totaling 14000. When the couple paid the excess refund 400 to the state in the prior year it increased their itemized deduction on their federal return.

For example - you deducted 1000 in state income taxes on your 2012 Schedule A. For example consider a taxpayer who pays no state income taxes in year 1 and takes no deduction in year 1 but pays 5000 with the state extension in April of year 2. Plumb The Tax Benefit Rule Today 57 HARV.

The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year income tax consequences of the later event depend in some degree on the prior related tax treatment. However in 2012 the taxpayer receives a state tax refund. Tax Benefit Rule 55 TAXES 321 1977.

A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross income for the later year to the extent of the original deduction. This common example has many variations. For example if a single taxpayers itemized expenses total 13000 they would likely.

The 1000 must be included in his current years reported gross income. If the couple received a state tax refund of 500 in the current year the taxpayer will include all of the refund in their current year income. Under the benefit principle taxes are seen as serving a function similar to that of prices in private transactions.

Had A paid only the proper amount of state income tax in 2018 As state and local tax deduction would have been reduced. Gross income does not include income attributable to the. A tax benefit also includes.

For example lets assume that in 2009 Company XYZ expected to receive 100000 from a. Other example is a claim against the taxpayer such as a local property tax or an employees salary which is deducted when paid. A taxpayer itemized in 2011 and deducted state income taxes paid in 2011.

Itemized deductions make sense if the sum of your qualified expenses is greater than your standard deduction. A rule that provides that the amount of an expense recovered must be included in income in the year of the recovery to the extent the original expense resulted in a tax benefit. If this principle could be implemented the allocation of resources through the public sector would.

Copyright 2008 HR Block. If the amount of the loss was not taken as a deduction in the year the. The rule is promulgated by the Internal Revenue Service.

7 The tax benefit rule applies not only to recoveries in a strict sense but also to situations involving increments to net worth. A tax benefit in the prior taxable year from that itemized deduction. Educational Assistance Exclusion for employer payments of student loans.

99514 1812a2 substituted reducing tax imposed by this chapter for reducing income subject to tax or reducing tax imposed by this chapter as the case may be. Its also the name of an IRS rule requiring companies to pay taxes on income that was previously written off but is subsequently recovered. Legal Definition of tax benefit rule.

Exception for highly compensated employees. When the state return is filed the taxpayer has an overpayment of 2000. The following examples provide an illustration of the mechanics of the tax benefit rule and how it should work with respect to the new law and the 10000 annual limitation.

Examples of tax benefit. Taxpayer makes payments of year 1 taxes in year 2. The Executive will receive an annual taxable benefit equal to the assumed cost of insurance to the extent required by the Internal Revenue Service.

A tax benefit is interpreted broadly and includes any exclusion deduction or credit which reduced federal income tax due in a prior year. Lets say everything is the same as the last example except your total itemized deductions total 20000. The tax benefit rule is codified in 26 USC.

A taxpayer used a standard deduction in 2011. Under the second definition of the benefits received rule an individual must subtract his or her contribution towards a tax deduction in order to reflect the true value of the contribution. Related Courses Small Business Tax Guide April 25 2022Steven Bragg Taxation Steven Bragg.

State income tax refund fully includable. The Bank will cause the amount of imputed income received annually to be reported to the Executive on Form W-2 or its equivalent. Jones recovers a 1000 loss that he had written off in his previous years tax return.

According to the tax benefit rule - part of the state income tax refund above standard deduction is included into 2012 taxable income. Joe and Denise Smith itemize deductions on their 2018 income tax return. In December 2017 as part of the Tax Cuts and Jobs Act PL.

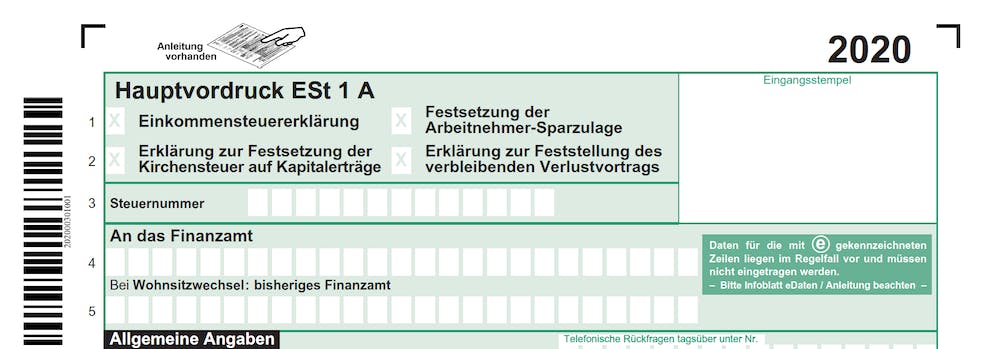

Income Tax In Germany For Expat Employees Expatica

Tax Advantages For Donor Advised Funds Nptrust

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Is A Homestead Exemption And How Does It Work Lendingtree

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Turning Losses Into Tax Advantages

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats

Germany Crypto Tax Guide 2022 Koinly

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Income Tax In Germany For Expat Employees Expatica

Section 80d Deductions For Medical Health Insurance For Fy 2021 22

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Germany Crypto Tax Guide 2022 Koinly

Income Profession Tax Benefits For Disabled Handicapped Persons

Income Taxation In Germany Gofrankfurttax

/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)